Uncategorised

- Hits: 1227

Madam Secretary and Mr Martinez:

Summary:

My wife and I are writing to you to ask for your attention to actions by the Sandoval County Assessor, Linda Gallegos, that are unconstitutional and ask that you take action under your supervisory rule as defined by NMSA §7-35-3 to correct the problems we have identified and ask that you do so prior to 2024’s valuation notice production. The unconstitutional act we ask to be corrected is the implementation of a flat rate valuation scheme for land across Corrales, of either 2.87/square foot west of Loma Larga or 4.68/square foot east of Loma Larga.

Background:

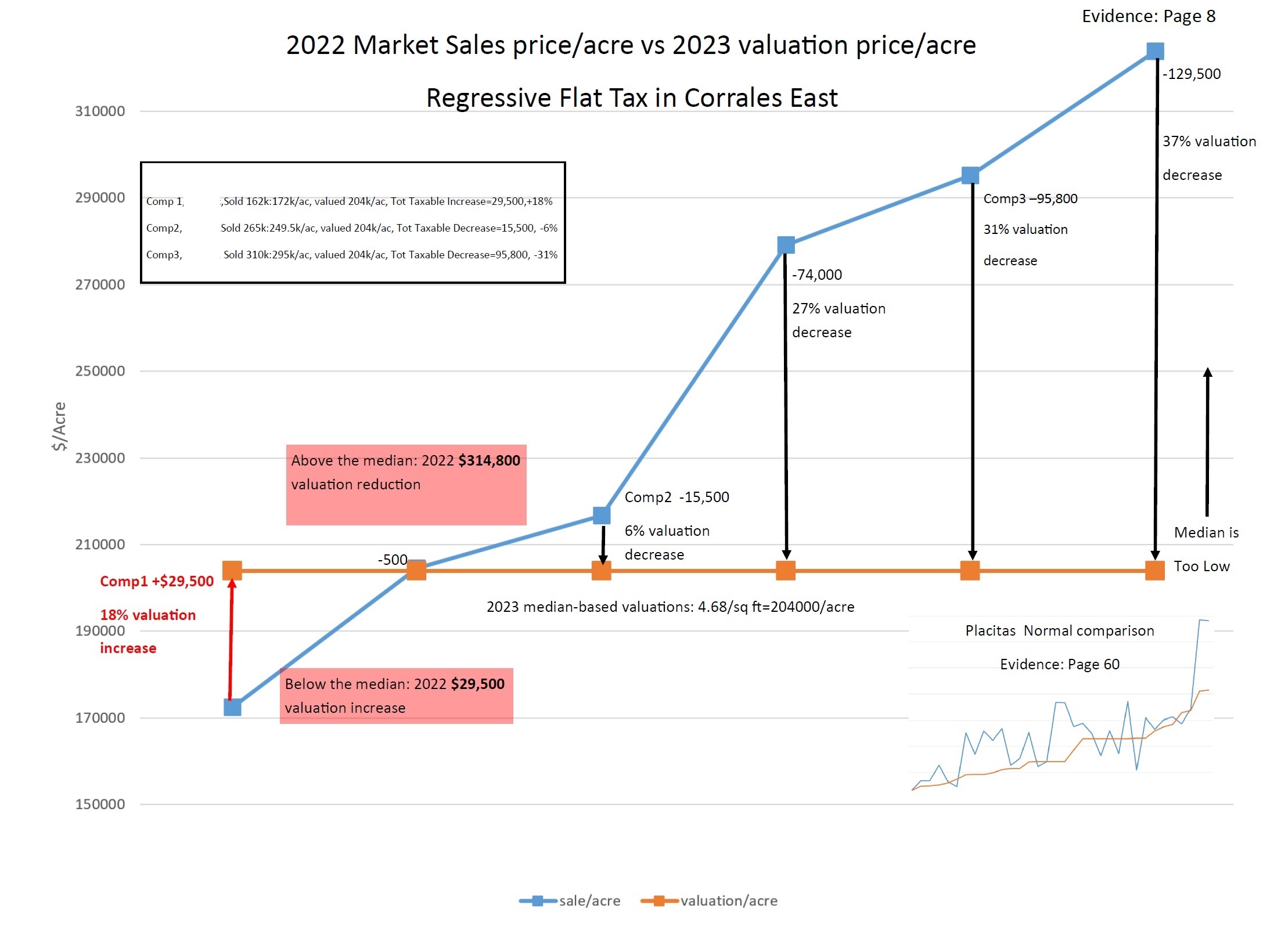

In December of 2022 a 1.05 acre plot of vacant land was sold 4 miles south of us for $295,000/acre and the Sandoval County Assessor valued that land a month later at $204,000/acre. A parcel of land that sold 3 miles south of us in 2022 for $172,000/acre was also valued at $204,000/acre as were all four of our properties – valued at $204,000/acre – as was every square foot of dirt in the 6 square miles east of Loma Larga road that was subject to full valuation which also included all 2022 residential property sales. This is not an isolated incident, it is a consistent, deliberate, systematic, discriminatory choice that has been in place for at least the three years we have been taxpayers in Corrales. The result of this discriminatory valuation practice is the ‘gift’ in excess of 30% below actual market value to the wealthiest property owners within Corrales and an attempted outrageous 27% ‘penalty’ upon our property.

Unconstitutionality:

The Assessor’s choice of a flat rate tax in Corrales is in violation of Article VIII Section 1 A of our constitution that states “taxes levied upon tangible property shall be in proportion to the value thereof, and taxes shall be equal and uniform upon subjects of taxation of the same class”. This valuation practice additionally establishes a violation of our equal rights protections under both the US and New Mexico Constitution, as well as the rights of many of my neighbors, who may not yet be aware of the specifics of this issue.

Our Personal Situation:

Our awareness of this practice was driven through gathering the facts for our 2023 valuations protest, our third protest in three years. On August 8 we protested the improper valuation of our 4 adjacent lots in Corrales, which were valued identically (per square foot) to lots as far away as 5.5 miles. An unlikely circumstance anywhere, but especially in Corrales which I’m sure you know is a very non-homogeneous environment. We have established the website http://corraleslandrights.org where you and our neighbors are able to review for yourselves the data that proves the unconstitutional acts. There are two documents you should review, our argument, a prima facie discussion of the specific violations of the law; and the evidence, based both on data provided by the Sandoval County Assessor as well as our own research into local sales. Based on these two documents the Sandoval County Protests Board found in our favor for our three vacant lots, but then inconsistently ruled against us for the fourth lot with our home on it, resulting in one of our four adjacent lots being valued 27% higher than its obvious, direct comparables.

While we pursue justice for our fourth lot (D-1329-CV-2023-01382), being heard by Judge Allison Martinez in the 13th District Court, the truth of the unconstitutional nature of land valuations and its impacts across the entirety of Corrales needs to be addressed and you are the only individual that has the authority to do so. We ask you to initiate an action under NMSA §7-35-6(A) which provides a reasonable 60 day window for Sandoval County to respond to you, at which time we would ask for the courtesy of a reply based on the results of your efforts.

We are pursuing this effort on our own, with no lawyer. As such we are tremendously disadvantaged against the three lawyers Sandoval County has assigned to defend Linda Gallegos’ actions. The county committed perjury during our protest hearing in their attempt to hide the truth of their actions and the county lawyers have now chosen to pursue frivolous procedural shenanigans in an attempt to avoid a review on the merits. We ask you to do the right thing under the constitution as well as state law - and we ask you to do this soon.

We provide below a summary from our protest, based on the data that was provided by the Sandoval County Assessor’s office (comp1,comp2,comp3 on the chart) as well as our own MLS data that was successfully used to challenge our 2023 valuations based on the proven truth of the unconstitutional flat rate method being applied in Corrales.

- Hits: 775

Linda Gallegos, the Sandoval County Assessor is represented by three tax-payer funded lawyers, trying desperately to maintain the county's unjust unconstitutional enrichment scheme. Perhaps they are afraid of whom else may decide to really dive into their taxes. I've only looked at my community. Sandoval County has executed an assault of frivolous legal actions upon us in order to attempt to avoid a review of our appeal on the merits. They have complained about scandalous language, font size, line spacing, page numbering and missing signatures and follow this up with an illegal cross-appeal and delaying tactics - oh and they never served the record to us as required by law - nice guys - all paid for by MY OWN TAX DOLLARS.

Here are the legal filings so far. Keep in mind that in a 'normal' appeal there should be very little back-and-forth....perhaps 6 events. The specific documents are in the table after my coloured commentary of events

March 7 - Another hearing request filed. This one was filed as a pretrial conference. How can there be a pretrial conference with no 'trial' set? Obviously another delay attempt by the county

December 18 - Our completion of briefing got filed today - it rolls up our initial motion to enforce the rules and disregard the hearing request and the county's response into a motion packet - motion packets are a requirement of LR13-118.

December 14 - The county responded with their opposition to our motion to enforce the rules - claiming there are no rules to violate!

December 5 - Our response to the request for hearing is that it is untimely and improper since it requests hearings on matters they themselves have already told the court require no hearing. We consider this a significant enough violation of the rules that we requested the court to apply the sterner disciplinary rules available to the court.

December 1 - No suprise the county's lawyer filed an opposition to our motion to dismiss - this one came by us mail though, not email. And he included a bonus move - a request for a hearing. Unfortunately appeal rules don't permit them to submit a standalone request for hearing after my completion of briefing was filed - and LR13-122 that doesn't allow them to change their completions of briefings after the fact - all issues they want to talk about had already completed briefing and their request for hearing was required to be submitted at the time they completed briefing.

November 22 - Due to the professional county lawyer's failure to abide by the basic rule for serving documents we have asked that everything filed on November 17 be dismissed. We have followed that back to the beginning and have asked to court to determine whether everything they've filed with us is improperly served and hence invalid. We also pointed out their lack of candor in the text of their motions - this one is worth a read imo.

November 17 - was a very busy day. It is 31 days after we filed our statement of the issues so we filed our completion of briefing, telling the court the appeal is ripe for review, without the response from the Assessor. And BOOM! The county filed three things. First they filed their completion of briefings for the motion to strike our statement, as well as for more time and then they filed an objection to our completion of briefing. Color: Regarding our opposition to their request for more time, they used the 'not my fault' excuse - blaming the failure to produce the record on time on the state - LOL weak. On the opposition to our completion of briefing, they basically said 'just because....' and provided no justification. As to their response on our opposition to striking our statement, they said that 'we arent allowed to file electronically' and here's the money quote 'There is no surer way to misread any document than to read it literally'. FFS

November 10 - We have filed our opposition to both the motion for more time and the motion to strike our statement of the issues. Both of these are simply frivolous wastes of time by our tax dollars.

October 26 - Another busy day for the county. They requested more time, a total of about 75 days to respond to our statement of the issues - because they are travelling and are busy - FFS! They also filed another meritless motion to strike, this time against our statement of the issues, claiming it was hard to read, did not follow a law that only applies to hard copy filings (we always file electronically), and expressed incoherently that our statement of the issues was scandalous.

October 19 - We filed our completion of briefing on the motion to dismiss the cross appeal

October 17 - We filed our statement of the issues, which set the clock running - they have 30 days (nov 16) to file their reply. Also, they responded to our opposition to their writ - by requesting more time and a chance to fix the shortcomings we had pointed out to them

October 16 - 36 days after we filed, the lawyers had not produced the record to us. And when we retrieved the record from the state, turns out they only included half of our evidence. We pointed out both failings. In response on October 17th they 'let us' set the clock to October 16th which is when the state sent an updated version of the record to the court. Our main appeal, the statement of the issues had been ready for days, just waiting to link it to the record

October 11 - We pointed out how their petition for a writ of certiorari was logically incontinent and asked for it to be denied by the court.

October 4 - They were busy. They provided meritless arguments as to why they should be allowed to cross appeal with a filing I describe as logically incontinent. And just to be safe they also filed a petition for a writ of certiorari which is a extraordinary request to the court on constitutional grounds to review a decision. The actual petition was a joke, no detail whatsoever AND requested they be allowed to appeal - which they can't have because the text of the law is clear....more logical incontinence.

September 26 - The lawyer filed a claim to cross appeal. The text of the law allows only property owners to appeal so that led to our motion to dismiss on October 2

| Date | Our Filing | Sandoval County Lawyer Filing |

| March 4 | Pretrial Conference request | |

| December 18 | Completion of Briefing, Motion to Enforce | |

| December 15 | Opposition to Motion to Enforce | |

| December 5 | Motion to Enforce 1-074 and disregard hearing | |

| December 1 | Opposition to Dismiss and Hearing Request | |

| November 27 | Completion of Briefing, Motion to Strike Appeal | |

| November 22 | Motion to Dismiss all November 17 filings | |

| November 17 | Opposition to Completion of Briefing of Statement | |

| Completion of Briefing, motion for more time | ||

| Completion of Briefing, motion to strike document | ||

| Completion of Briefing, Statement of the Issues | ||

| November 10 | Opposition to Appellee Motion to Strike Statement | |

| November 9 | Opposition to Appellee Motion for more time | |

| October 26 | Motion to strike October 17 Statement of the Issues | |

| October 26 | Motion for more time to file Response to October 17 Statement | |

| October 19 | Completion of Briefing: Motion to Dismiss Cross Appeal | |

| October 17 | Completion of Briefing: Petition of Writ with motion to amend | |

| October 17 | Statement of the Issues | |

| October 17 | Response to October 16 Failure to Produce the Record | |

| October 16 | Failure to Produce the Record | |

| October 11 | Opposition to October 3 Petition for Writ | |

| October 6 | Response to October 4 Response wrt dismissing cross appeal | |

| October 4 | Response to October 2 Motion to Dismiss | |

| October 3 | Petition for Writ of Certiorari | |

| October 2 | Motion to Dismiss Cross Appeal for Lack of Standing | |

| September 26 | Motion to Strike Appeal | |

| September 26 | Notice of Cross Appeal | |

| September 11 | Notice of Appeal |

- Hits: 849

This is my coloured commentary on bad behavior of Linda Gallegos and her employees. The dry legal version is within our statement of the issues.

For anyone that wants the entire record, it consists of a large PDF file and the 3 1/2 hour audio recording. Click right and save link to get these large files for yourselves.

Because that's a lot to go through I've pulled out some of the most outrageous statements and actions to comment upon and for those that occurred on the record, I include the record to help illustrate my point.

First up is Linda's senior assessor acknowledging that every lot in 6 square miles is valued the same thing and justifying their actions by saying that the supreme court does not require 100% accuracy and that if the tax payers dont like it, it is their burden to protest. WOW, just..WOW!

Here's the law: NMSA 7-36-15 Unless a method or methods of valuation are authorized in Sections 7-36-20 through 7-36-33 NMSA 1978, the value of property for property taxation purposes shall be its market value as determined by application of the sales of comparable property, income or cost methods of valuation or any combination of these methods. In using any of the methods of valuation authorized by this subsection, the valuation authority shall apply generally accepted appraisal techniques.

One of those is not like the other!

The most outrageous act by far was the absolutely disrepectful manner in which I was treated by the assessor and her employees. I met with the assessor's office TWO TIMES in order to get the information on how my valuation was calculated - one time with Linda herself and three of her staff. Rather than provide me any information whatsoever they expressed repeatedly that I had to 'trust your assessor' - which hopefully you all understand from reading this - DONT TRUST YOUR ASSESSOR!

They never provided anything in the informal meetings and made me do a public records request which I did - here it is - my comparables from the county. This is where it gets ugly. During the protest hearing, under oath, the assessors didn't actually USE the data they had given me - they introduced a DIFFERENT SET OF COMPARABLES. I emphasize this because it is a bad thing! Everyone has the legal right to know how their taxes are calculated and in spite of three attempts to get the information -they simply refused to provide it to me.

But - it got worse. I called them on it in the hearing - we objected several times to the data being changed - and they denied it....here are the assessors literally using that term: He says 'we deny we ever sent you that' FFS! and of course they didnt provide a damn thing in my two informal hearings with them which is what he claimed in this audio - all under oath - it was formally produced as a part of my IPRA discovery request.....Our tax dollars at work...

Linda I don't think likes me and she expressed this in the meeting . Imagine an elected government employee coming after YOU like she did me - there's are lots of words to describe this - bullying is a nice way to say it, but there are other ways: slanderous, disparaging, insulting, derogatory, belittling, vilifying - a malicious character assault by an elected government official on a private citizen - I guess they must really want my money.

Nice folks huh. But they weren't done yet. There is a long list mentioned in our statement of issues where the supposed expert property tax assessors misstated the fundamentals of the law to the board. Why? perhaps to try to confuse the board as to how the law is written? We objected several times to their statements. Here's the lowdown: They never, EVER, argued that what they do is value every single square foot of land the same thing - 4.68/sq ft east of loma larga and 2.87/sq ft west of loma larga. Instead they spent every opportunity they had to talk in attacking me and my data. Their 'directions about the law' that were wrong were meant to declare my data as not relevant. Here's one clip - the assessor says that in order to challenge his valuation of my land, I MUST produce my own valuation alternative . Just this once I'll quote the law - for the other instances you'll have to read the statement of the issues. But to summarize what was going on, the law gives the assessor a huge benefit of the doubt, called the presumption of correctness. In order to assert my actual property value, I first had to overcome the presumption of correctness - ie I had to prove him wrong. Here's the law: NMAC 3.6.7.13 To overcome the presumption of correctness provided in Section 7-38-6 NMSA 1978, the taxpayer has the burden of coming forward with evidence showing that values for property taxation purposes determined by the division or the county assessor...are incorrect. Nothing in that law says butkus about 'must provide a number'. In the record they got the law wrong several times, but we limited ourselves to the 5 most significant in our statement of the issues.

Another simply outrageous assertion by our Senior, Expert Assessor - he said the sales price of a home MAY NOT be used in the valuation of that home. Another objection from us - and even though it took him 5 minutes, he finally agreed that...yes in fact the sales price of a home is very relevant to establishing the valuation of any home. In the question I was asking how he can justify a property that sold Late '22 for $310k to be only valued at $215k 3 months later - the crux of my unconstitutional argument and I apologize to everyone who has been getting a huge tax break from the county.

There was also alot of factual inconsistency we point out, the assessor asserting different facts at different times. You may not know but the assessor has an arbitrary line drawn down the middle of Corrales, following Loma Larga, and in our informal meetings they repeatedly told me that we can't compare to properties across Loma Larga. He didn't have any data or justification for this...he just said it. But in the hearing as I was describing why the assessor won't let me compare my properties to properties 1/2 mile west of me, but he is allowed to compare me to properties 5 miles south...he objected! Said he never told me this.But as he was wrapping up at the end of the meeting, the truth came out - yes in fact they do NOT allow properties to be compared across Loma Larga . The same guy - three and a half hours apart...which statement do you believe?