Welcome. This is a quick explanation of the unconstitutional property taxes in Corrales New Mexico.

The complete data is here

The complete legal argument is here

April 5 2025 - 2025 tax bills are in and the Assessor has continued to violate the constitution. She has established 3 standard valuations for corrales. East of Corrales Road the valuation increased from 204k/acre in 2024 to 290k/acre. Between Corrales Road and Loma Larga the increase was from 204k to 235k and west of Loma Larga the increase is from 166k to 200k. Our ethics complaint has been repeatedly cancelled by the county so we are still waiting to have our evidence of the assessor's false statements and data manipulation heard by the county. We have our 2024 taxes under review by the district court, complaining that the assessor's method of using these three huge property groups to value everyone identically is unconstitutional - the judge has not said anything as of April. The other constitutional assault that we are challenging is the assessor is automatically assigning a 3% valuation increase on properties with out establishing a valuation. This is another clear violation of the law that says that our valuation increases must be based on the actual value of our properties but is limited to a 3% increase annually: NMSA 7-36-21.2 A. Residential property shall be valued at its current and correct value in accordance with the provisions of the Property Tax Code; provided that for the 2001 and subsequent tax years, the value of a property in any tax year shall not exceed the higher of one hundred three percent of the value in the tax year prior to the tax year in which the property is being valued or one hundred six and one-tenth percent of the value in the tax year two years prior to the tax year in which the property is being valued.

November 7 2024 - Another win. The Sandoval County Ethics Board has agreed to investigate our complaint that the assessor and her employees violated the law when they produced a total of 3 different valuations for our property and lied about it under oath. The next step in this will be an evidentiary hearing where the board can consider the evidence in detail. This was in spite of telling us we could only talk for 5 minutes and then letting the assessor's lawyer talk for nearly 20 minutes.

September 26 2024 - This just in - We WON! A non-lawyer beat the Assessor's FIVE no-good bum lawyers.

The 13th district court judge has ruled on our case. The entire opinion is here .

To summarize the judge's opinion she states "Here, based on the evidence of the variability of the properties in Corrales and the differences between the properties in the north of Corrales and the properties in the south, the board in effect concluded that the assessor failed to comply with the first requirement, in that she did not appropriately define the universe of similar properties. Instead of looking only at those properties in a similar location in the north of Corrales with similar amenities, the assessor included sales of properties in the south of Corrales, which were more desirable and more valuable for a number of reasons. Accordingly, the requirements of the mass appraisal technique as approved under New Mexico law were not met. The board found that the evidence at the hearing demonstrated that the DeHoffs' property should not be valued the same as those in the southern part of the village. That decision was supported by substantial evidence."

My plain language interpretation: The assessor violated state law by ignoring significant property characteristics like actual market sales values, which led to every property she uses this method against (all of us) having an identical valuation.

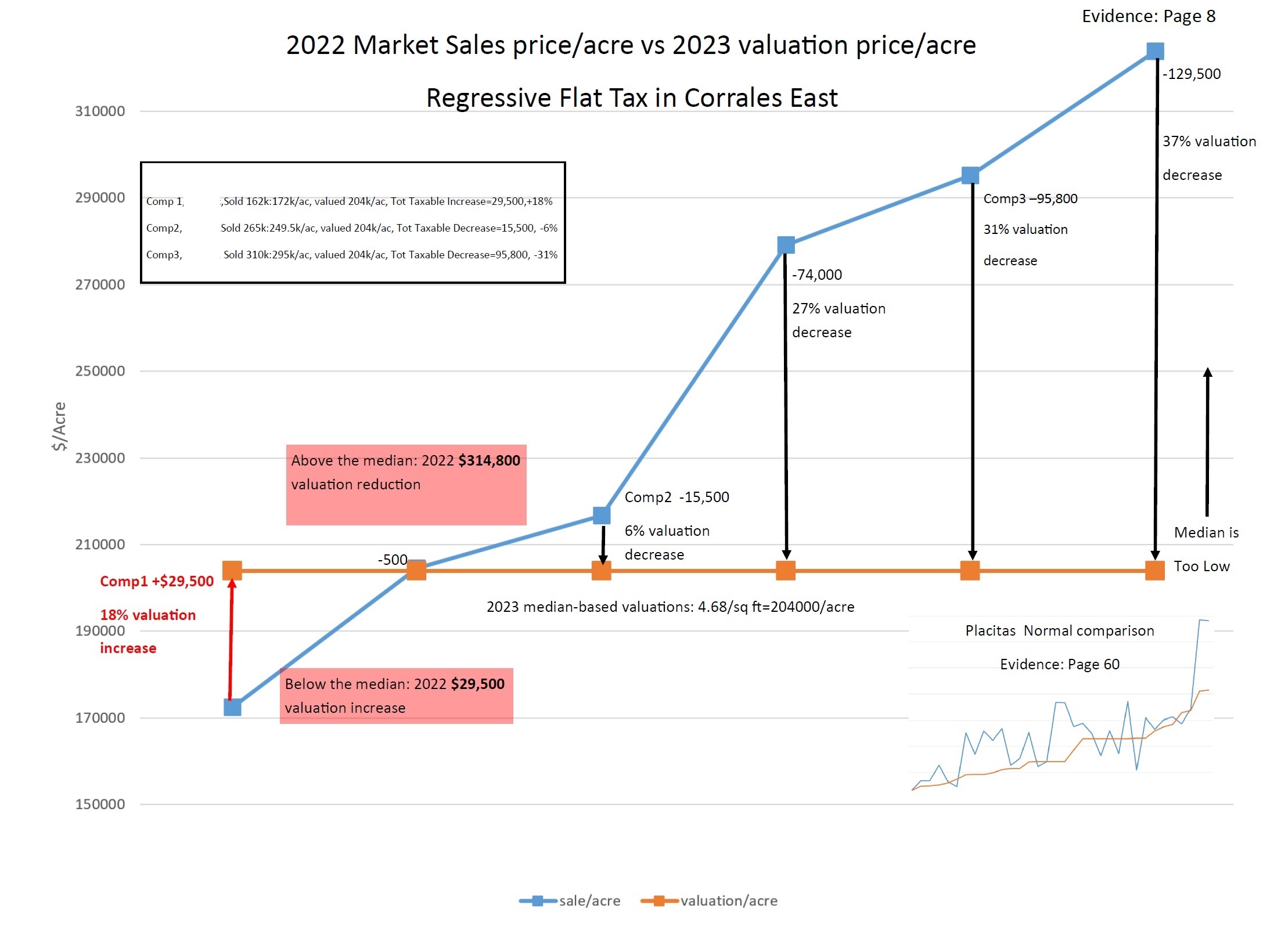

In 2022, the year this argument was initiated, Land sales east of Loma Larga ranged in price from 172k/acre to 323k/acre. Instead of valuing these properties based on their market value the assessor applied a community wide assessment - everyone is paying 204k/acre. A person bought a lot around east ella in 2022 for $295k/acre and that lot is still valued in 2024 for taxation at $204k/acre - saving that person from paying tax on $91k/acre every year from now own. And across Corrales Road in that same area another lot, sold for $323k/acre is still valued at $204k/acre, a 119k/acre discount that owner never has to pay taxes on - EVER. Wouldn't we all like that deal! 204k/acre is applied to all vacant land and recently sold residential properties. The chart below shows actual data from 2022 and the 3 values comp1, comp2, comp3 are the assessor's own data. By guaranteeing a steep discount to the most valuable property sales in the community, this regressive tax shifts the burden of taxation to the less valuable properties - a violation of our constitution.