Uncategorised

- Hits: 2302

Welcome. This is a quick explanation of the unconstitutional property taxes in Corrales New Mexico.

The complete data is here

The complete legal argument is here

April 5 2025 - 2025 tax bills are in and the Assessor has continued to violate the constitution. She has established 3 standard valuations for corrales. East of Corrales Road the valuation increased from 204k/acre in 2024 to 290k/acre. Between Corrales Road and Loma Larga the increase was from 204k to 235k and west of Loma Larga the increase is from 166k to 200k. Our ethics complaint has been repeatedly cancelled by the county so we are still waiting to have our evidence of the assessor's false statements and data manipulation heard by the county. We have our 2024 taxes under review by the district court, complaining that the assessor's method of using these three huge property groups to value everyone identically is unconstitutional - the judge has not said anything as of April. The other constitutional assault that we are challenging is the assessor is automatically assigning a 3% valuation increase on properties with out establishing a valuation. This is another clear violation of the law that says that our valuation increases must be based on the actual value of our properties but is limited to a 3% increase annually: NMSA 7-36-21.2 A. Residential property shall be valued at its current and correct value in accordance with the provisions of the Property Tax Code; provided that for the 2001 and subsequent tax years, the value of a property in any tax year shall not exceed the higher of one hundred three percent of the value in the tax year prior to the tax year in which the property is being valued or one hundred six and one-tenth percent of the value in the tax year two years prior to the tax year in which the property is being valued.

November 7 2024 - Another win. The Sandoval County Ethics Board has agreed to investigate our complaint that the assessor and her employees violated the law when they produced a total of 3 different valuations for our property and lied about it under oath. The next step in this will be an evidentiary hearing where the board can consider the evidence in detail. This was in spite of telling us we could only talk for 5 minutes and then letting the assessor's lawyer talk for nearly 20 minutes.

September 26 2024 - This just in - We WON! A non-lawyer beat the Assessor's FIVE no-good bum lawyers.

The 13th district court judge has ruled on our case. The entire opinion is here .

To summarize the judge's opinion she states "Here, based on the evidence of the variability of the properties in Corrales and the differences between the properties in the north of Corrales and the properties in the south, the board in effect concluded that the assessor failed to comply with the first requirement, in that she did not appropriately define the universe of similar properties. Instead of looking only at those properties in a similar location in the north of Corrales with similar amenities, the assessor included sales of properties in the south of Corrales, which were more desirable and more valuable for a number of reasons. Accordingly, the requirements of the mass appraisal technique as approved under New Mexico law were not met. The board found that the evidence at the hearing demonstrated that the DeHoffs' property should not be valued the same as those in the southern part of the village. That decision was supported by substantial evidence."

My plain language interpretation: The assessor violated state law by ignoring significant property characteristics like actual market sales values, which led to every property she uses this method against (all of us) having an identical valuation.

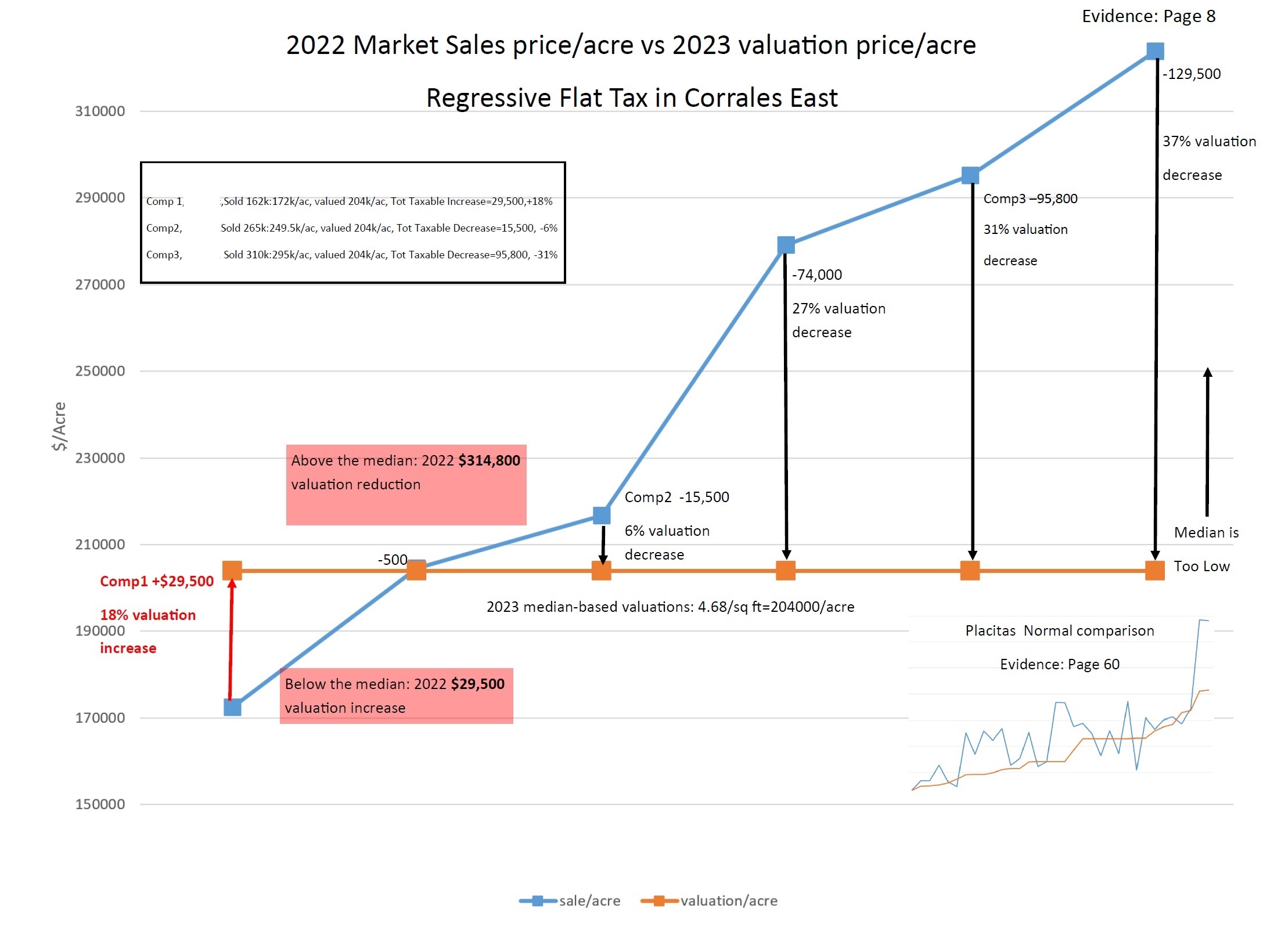

In 2022, the year this argument was initiated, Land sales east of Loma Larga ranged in price from 172k/acre to 323k/acre. Instead of valuing these properties based on their market value the assessor applied a community wide assessment - everyone is paying 204k/acre. A person bought a lot around east ella in 2022 for $295k/acre and that lot is still valued in 2024 for taxation at $204k/acre - saving that person from paying tax on $91k/acre every year from now own. And across Corrales Road in that same area another lot, sold for $323k/acre is still valued at $204k/acre, a 119k/acre discount that owner never has to pay taxes on - EVER. Wouldn't we all like that deal! 204k/acre is applied to all vacant land and recently sold residential properties. The chart below shows actual data from 2022 and the 3 values comp1, comp2, comp3 are the assessor's own data. By guaranteeing a steep discount to the most valuable property sales in the community, this regressive tax shifts the burden of taxation to the less valuable properties - a violation of our constitution.

- Hits: 548

A guide to protesting your property valuation increase in Corrales.

This guide is a summary of how we protested and won against our valuation increase attempts. It is important to note that the result of our protest was to keep our valuation exactly where it is and we did not reduce our valuation at all – but the assessor tried 3 times (so far) to increase our valuations by 27 percent!

The first step is to prepare.

The assessor is legally required to give you the details of your valuation. That specifically should be a list of the properties your property was compared to and the math they used to establish your value. The assessor should give this to you if you ask for it, in an excel spreadsheet or possibly just a list. It is a small amount of information, less than 1 page. But in our case she refused to give us the information when we requested, so we had to go a second step, which was to legally request the information with a public records request (IPRA). If she refuses to give you the information or only gives it to you verbally, that’s not good enough. Get the document and if you have to, sign up and use the Sandoval county IPRA website to make this request: “I am requesting the comparable property Property IDs and methods used to determine my 2025 property valuation on <whatever your property id is, the Rxxxxxx on your notice>”.

Be sure to state that you want the Property ID which is either a UPC code or an 'R' account number so you can look these up in the Assessor's database.

https://www.sandovalcountynm.gov/public-records-request/

The second step is to determine whether you have a case based on the information she gave you.

This is core of the argument we won. The assessor compared our property which is on the very north end of Corrales Road to the nicest properties in Corrales – 5 miles south of us on along the Bosque. As you review the spreadsheet you have from the assessor you will be given a property ID for each property you were compared against. You can use the property tax website to look these up:

https://www.sandovalcountynm.gov/elected-officials/county-assessor/parcel-mapping/

You can use the search function to type in the property ID and the parcel viewer will show you that property you were compared to. Now you know the properties you were compared against. You have to answer a question. Based on these criteria, are the properties you were compared to the same or similar to yours: Size, shape, location, topography, accessibility and utilities availability. Homes that are several miles away from yours are not in the same location, are you on a dirt road and being compared to properties on a public paved street? That’s another difference. Are you on the escarpment being compared to properties along Loma Larga – again you’re not the same. Are you on the sandy side of Corrales being compared to properties in the green belt?

The third step is to file the protest form.

If you determine that any of those properties the assessor used is not like yours, you’ve got a case like ours. You can go to protest and state that the assessor compared you to non-comparable properties based on those differences you highlighted above, and you would say you want your valuation to remain the same based on the fact that there were no comparable properties close enough to justify a change in your valuation.

https://www.sandovalcountynm.gov/elected-officials/county-assessor/forms/

Find the “protest petition” form at the bottom of this page, fill it out using your current year’s valuation. As an example for 2024 everyone west of loma larga had their valuation go from 125k/acre to 166k/acre. You would use 166k as the total assessor’s value, 125k as total property owner’s value and 41k as the protested amount. Your explanation is that the comparables provided by the assessor are not comparable as determined by the district court D-1329-CV-2023-01382. That citation is the court case my wife and I won that says the assessor fails to consider actual property characteristics in selecting their comparable properties, which is unlawful.

- Hits: 583

6/10/2024 Our ethics decision was predetermined by a flawed and biased opinion of the 'neutral' compliance officer - read here in full.

The highlights - violation of the constitution, violation of state law are not unethical according to the ethics ordinance.

The ethics ordinance is limited to making sure no one steals from the county kitty - but by all means squeeze the citizens for as much as they can get - that's not unethical...just saying.

- Hits: 1409

From:

Kenneth DeHoff

66 Bad Coyote Place, Corrales New Mexico

505-867-6236

To:

New Mexico Tax and Revenue Secretary Stephanie Shardin Clarke

CC:

New Mexico State House Representative Alan Martinez District 23

New Mexico State Senator Brenda McKenna District 9

New Mexico Property Tax Division Director Ira Pearson

Sandoval County Commission Member Jay Block

Sandoval County Commission Member Katherine Bruch

Sandoval County Commission Member Dave Heil

Sandoval County Commission Member Michael Meek

Sandoval County Commission Member Joshua Jones

New Mexico State Attorney General Raul Torrez

New Mexico Governor Michelle Lujan Grisham

Congresswoman Melanie Stansbury

Senator Martin Heinrich

Senator Ben Ray Lujan

Regarding: Meeting Request: Follow up from December email to investigate Sandoval County Assessor for illegal and unconstitutional taxation practices in Corrales

Madam Secretary:

As I hope you recall, I raised an issue regarding the unconstitutional flat rate land valuations in Corrales on December 21. I appreciate your very quick response and commitment to investigate and hope that the investigation is continuing. I write to update you on additional factors regarding both our just released and yet-again illegal 2024 valuations as well as illegal actions by Linda Gallegos that I believe obligate a response from you in the near term under NMSA 7-35-6. I provide specifics that I hope enable you to complete your investigation and take appropriate action. I will also ask for you to work with the Sandoval County Commission to correct what I believe to be improper public intimidation established by public comments made by Linda Gallegos and her Senior Assessor Ed Olona. As concerning as this email should be to you, it does not capture the full scope of illegality I am facing. I ask that you organize a meeting with me and my wife at your earliest convenience so we may discuss more fully our circumstances face to face. We will accommodate your schedule.

First, as to our 2024 valuation.

As you recall, I protested in 2023 for our farm’s properties at the North end of Corrales; 4 adjacent 1 acre lots; 3 vacant for crops and 1 with our home on it. I received a favorable judgement against the Sandoval County Assessor in my 2023 protest with Finding #22:

“ The Property Owner’s evidence and testimony convinced the Board that the land values in south Corrales are not comparable to north Corrales. Thus for the three vacant parcels, the Board finds the property owner met and overcame the statutory presumption of correctness as to value.”

This hard-fought and won Finding in my favor prevents my property valuations from being based on the 2022 property sales introduced by the assessor as comparables for my properties. This order has not been adhered to by the county assessor. For the fourth year in a row, my property has been revalued, the 27% increase identical to last year’s attempted increase and obviously based on the use of the 2022 property sales the board rejected as comparables.

In my community there were only two validated land sales in 2023 as you can see from the attached Assessor’s IPRA response to my question – “what properties did you compare mine to for valuation purposes in 2024”. The valuation method applied uniformly to the rest of my community is based on 2023 comparable sales – of which there were only two which the assessor noted in the IPRA response as “not enough new sales” resulting in no valuation changes for my neighbors. But for my property valuation method the assessor has obviously applied 2022 comparable sales – those same comparable sales that VPB Finding #22 prevents the assessor from using in their valuation methods of my properties. The lawlessness in this action is breathtaking. Not only does the assessor flout the direct orders of the VPB by revaluing my property based on those sales the board explicitly ordered the assessor not to use, the assessor does this non-uniformly to my properties in blatant violation of 7-36-15(A) and NM Const Art VIII Sec 1.

The Assessor’s valuation method in my community is trivial. Calculate the median value from a list of 3 sales anywhere within the entire 6 square mile, 2500 lot area and then apply this single value per square foot to every other targetable square foot of land across the entire 6 square mile area. This trivial one-rate policy provides no consideration of the usual property characteristics such as market, location, access and public services as required by the tax code NMSA 7-36-15(B). This establishes a structurally guaranteed discount of 30% or more BELOW fair market value for the most valuable lands’ owners and a structurally guaranteed penalty of 27% or more ABOVE fair market value for the least valuable lands’ owners. The assessor’s one-rate policy continues in 2024 to be a regressive tax upon me and my community, it continues to be unconscionable and it continues to be unconstitutional.

I ask you to intervene on mine as well as your board’s behalf to enforce VPB finding #22, correct my 2024 property tax valuations and ensure I am treated uniformly under the law by leaving my valuation where it is due to insufficient contemporary 2023 comparable sales data near me. I find myself in a groundhog day loop having to reargue that which I believe has already been decided. I believe your role as defined by NMSA 7-35-3 (A) establishes that you are my ‘go to’ person to get this fixed in your supervisory role over the Sandoval County Assessor. I would very much like to work with you to get this resolved permanently and am happy to provide any additional information you may need – but the lawlessness of the Sandoval County Assessor needs to stop. If you need to review the data, it is all available on my website and due to the lack of sales in 2023 it is still up to date http://corraleslandrights.org/

Second as to your obligation to act under NMSA 7-35-6 (B)

Linda Gallegos’ blatant disregard of the law and constitution does not stop with my 2024 valuations. I ask you to read the entire recent Rio Rancho Observer article https://rrobserver.com/what-does-the-sandoval-county-assessors-office-do-and-why-is-it-important-for-residents/ . Within the article, Senior Assessor Ed Olona and Linda Gallegos both are quoted, bragging about appealing to district court - and winning - against RR Premiere Realty, LP.

I am confident you are familiar with the text of NMSA 7-38-28(A) “A property owner may appeal an order made by the director or a county valuation protests board by filing an appeal pursuant to the provisions of Section 39-3-1.1 NMSA 1978.” And I trust you are also familiar with the long-established Addis precedent: “The county assessor may not appeal the order of the VPB; only the property owner may appeal.”

How can an Appeal the county has no statutory right to pursue have happened?

Consider also Giddings v. SRT-Mountain Vista, LLC 2019-NMCA-025 “In the absence of a direct right to appeal from an adverse valuation protests board determination, or other mode of review on behalf of a county assessor, we agree with the Assessor that certiorari is the appropriate means of determining whether the Board exceeded its jurisdiction or proceeded illegally in the underlying agency proceedings.”. I could go on with precedent. Are you able to identify a single precedent that states that an assessor has the statutory right of appeal of the orders from a valuation protests board decision? The answer is no. And yet Linda Gallegos is quoted in the paper bragging about bringing this very action against a private citizen and depriving that citizen of $60,000 in the process (Their case is D-1329-CV-2022-01364 if you need to look it up, where Linda Gallegos illegally claimed the statutory right of appeal under NMSA 7-38-28, NMSA 39-3-1.1 and 1-074 NMRA).

Quoted from the Rio Rancho Observer Article:

“Do you have an example of a type of protest?

In 2022 Rio Rancho Premiere Realty LP protested their property tax in April, which is timely for the year, and they consequently said that their value should be at $4.5 million,” Olona said. “We assessed the property at approximately $9.3 million. It went through the protest board, and the board ruled not necessarily in favor of the county or the property owner. They came to their own conclusion as to the appropriate value. We appealed the decision in order by the property valuation board to district court. Ultimately district court found error with that decision and re-instituted our approximate $9.3 million valuation

….

“That’s $60,000 additional dollars. If we would have just said OK, we didn’t fight the lower amount, but we said no, we can defend our value, we know we have the right valuation,” Gallegos said. “So again, it’s about doing our job and making sure we’ve got the correct assessment and then be able to defend that. It’s an extra $60,000 for the people of Sandoval County.”

How can an Appeal the county has no statutory right to pursue have happened!?

Deceit.

In my case Linda Gallegos and her lawyer have lied by providing a deceptively edited version of NMSA 39-3-1.1(C) to Judge Martinez of the 13th District Court in their cross appeal filing against me, defrauding the court into considering that any aggrieved person has the right of appeal. I include the associated ethics complaint I have recently filed with the Sandoval County Commission as the factual basis for your further action in this matter, including Linda Gallegos’ relevant legal filings but it is public record if you want to pull the papers for yourself, D-1329-CV-2023-01382.

I ask you, based on your duty under the law NMSA 7-35-6 to Issue an order to the Sandoval County Assessor and Commission as required by NMSA 7-35-6(B) to show cause as to why the county assessor’s functions should not be suspended due to her deliberate and repeated violations of the property tax code and the state constitution. I’ll start the list: Two Violations of NMSA 7-38-28, two violations of NMSA 39-3-1.1, two violations of 1-074 NMRA and one violation of 1-074(H) NMRA in cases D-1329-CV-2023-01382 and D-1329-CV-2022-01364, an uncountable number of violations of NMSA 7-36-15 (B) and NM Const Art 8 sec 1 and at least one count of violation of NM Const Art 2 Sec 18 . NMSA 7-35-3 requires you to complete this list on your own. Who else has she illegally appealed against? Where else in Sandoval County are unconstitutional valuation practices being used?

Third, as to a partnership with Sandoval County Commission

Consider the chilling nature of Linda’s public message in the newspaper as The Assessor – that she will spare no taxpayer’s expense to sue anyone - from a church to a farmer - if she does not like the outcome of the valuation protests board, the very body that is charged with the final say over the assessor’s office to prevent errors and malicious overreach. The complexity and cost of valuation protests is already outrageous, an industry unto itself – and her message only serves to frighten and intimidate the public into now having to consider a never ending legal fight, having to hire and indefinitely retain a lawyer to defend against an assessor who will never abide by the valuation protest board orders because she will always have them under appeal, year after year because she can do so without any financial or personal investment or consequences to herself. This is precisely the grinding wheel I find myself against, four years running, a farmer once again having to respond to 2024’s illegal and unconstitutional valuations of my property while still prosecuting 2023’s illegal and unconstitutional valuations instead of planting my corn - and dreading 2025.

I ask you to publish in a timely fashion a public declaration and correction from your office in partnership with the Sandoval County Commission, who are direct financial beneficiaries of the unlawful methods and actions of Linda Gallegos, to be sent to the Rio Rancho Observer and other local papers, that directly addresses and corrects the improper threat of appeals upon the public attributed to Ed Olona and Linda Gallegos. The public is currently ‘doing their calculus’ as to whether it is worth it to protest and have but 30 days to decide so time is of the essence. It is in the public’s interest to know unambiguously that the assessor CAN NOT EVER and WILL NOT EVER appeal decisions of the VPB.

Finally, as to your difficult job ahead

As you consider your duty under the law which I suspect will not be easy, also consider the impact of Linda Gallegos’ actions – the irreversible damage already done to the Corrales property tax base; the publically observable malfeasance of Linda Gallegos and its impact on the entire county. Also consider the impact this ongoing malfeasance has had upon my wife and me – thousands of hours of grief and anger while I pour over opaque tax policy and legal documents and theories; lost crops while my wife struggles to run the farm on her own while I struggle to understand the law to defend ourselves against our government. We argue constantly over our options to get out of this mess, including leaving the state we have loved for 40 years. Sandoval County is the only home we have ever known together. As hard as this might be for you, this has been hell on earth for us for the past 3 years and it still is.

My complaints are based on obvious observable facts, not opinion, not inference, not speculation. I am but a single data point and I ask you to do everything possible under your authority to comprehend the full scope and breadth of the misdeeds and unjust enrichment within the assessor’s office. We allege and document additional egregious illegal behaviors on the part of the Sandoval County Assessor within our district court appeal and are confident these will be publically proven and disclosed by the court at which time you will have to consider them as additional facts. Please ensure that someone like me who is expected to follow the law will be able to observe the government hold itself to that same standard.

I would finally ask for your assistance by having the assessor’s illegal appeal against me dismissed along with the other dozen related, frivolous and harassing actions filed by Linda Gallegos – I look forward to seeing an appropriate filing on our case in the 13th District Court to this effect, Case # D-1329-CV-2023-01382.