Madam Secretary and Mr Martinez:

Summary:

My wife and I are writing to you to ask for your attention to actions by the Sandoval County Assessor, Linda Gallegos, that are unconstitutional and ask that you take action under your supervisory rule as defined by NMSA §7-35-3 to correct the problems we have identified and ask that you do so prior to 2024’s valuation notice production. The unconstitutional act we ask to be corrected is the implementation of a flat rate valuation scheme for land across Corrales, of either 2.87/square foot west of Loma Larga or 4.68/square foot east of Loma Larga.

Background:

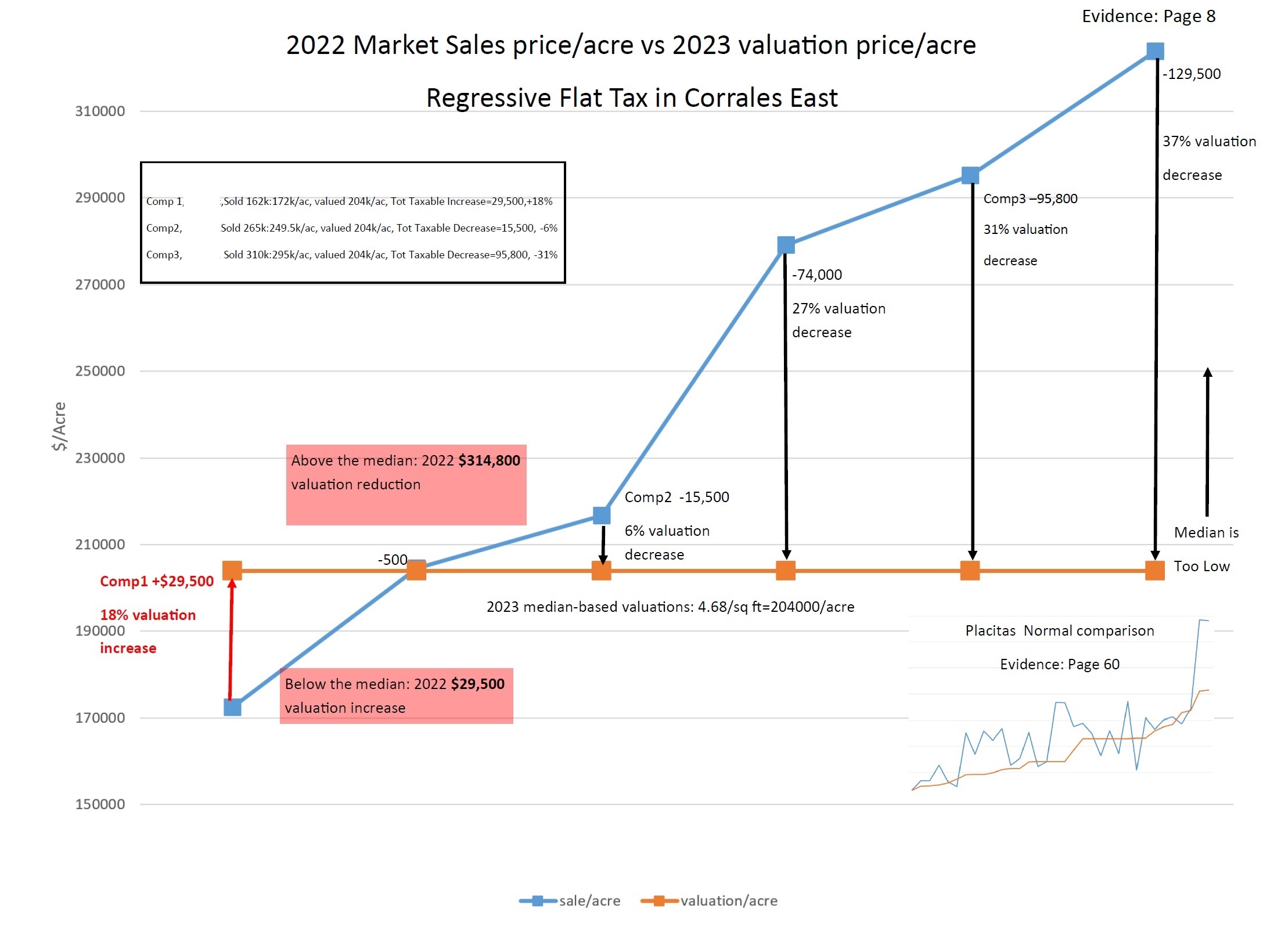

In December of 2022 a 1.05 acre plot of vacant land was sold 4 miles south of us for $295,000/acre and the Sandoval County Assessor valued that land a month later at $204,000/acre. A parcel of land that sold 3 miles south of us in 2022 for $172,000/acre was also valued at $204,000/acre as were all four of our properties – valued at $204,000/acre – as was every square foot of dirt in the 6 square miles east of Loma Larga road that was subject to full valuation which also included all 2022 residential property sales. This is not an isolated incident, it is a consistent, deliberate, systematic, discriminatory choice that has been in place for at least the three years we have been taxpayers in Corrales. The result of this discriminatory valuation practice is the ‘gift’ in excess of 30% below actual market value to the wealthiest property owners within Corrales and an attempted outrageous 27% ‘penalty’ upon our property.

Unconstitutionality:

The Assessor’s choice of a flat rate tax in Corrales is in violation of Article VIII Section 1 A of our constitution that states “taxes levied upon tangible property shall be in proportion to the value thereof, and taxes shall be equal and uniform upon subjects of taxation of the same class”. This valuation practice additionally establishes a violation of our equal rights protections under both the US and New Mexico Constitution, as well as the rights of many of my neighbors, who may not yet be aware of the specifics of this issue.

Our Personal Situation:

Our awareness of this practice was driven through gathering the facts for our 2023 valuations protest, our third protest in three years. On August 8 we protested the improper valuation of our 4 adjacent lots in Corrales, which were valued identically (per square foot) to lots as far away as 5.5 miles. An unlikely circumstance anywhere, but especially in Corrales which I’m sure you know is a very non-homogeneous environment. We have established the website http://corraleslandrights.org where you and our neighbors are able to review for yourselves the data that proves the unconstitutional acts. There are two documents you should review, our argument, a prima facie discussion of the specific violations of the law; and the evidence, based both on data provided by the Sandoval County Assessor as well as our own research into local sales. Based on these two documents the Sandoval County Protests Board found in our favor for our three vacant lots, but then inconsistently ruled against us for the fourth lot with our home on it, resulting in one of our four adjacent lots being valued 27% higher than its obvious, direct comparables.

While we pursue justice for our fourth lot (D-1329-CV-2023-01382), being heard by Judge Allison Martinez in the 13th District Court, the truth of the unconstitutional nature of land valuations and its impacts across the entirety of Corrales needs to be addressed and you are the only individual that has the authority to do so. We ask you to initiate an action under NMSA §7-35-6(A) which provides a reasonable 60 day window for Sandoval County to respond to you, at which time we would ask for the courtesy of a reply based on the results of your efforts.

We are pursuing this effort on our own, with no lawyer. As such we are tremendously disadvantaged against the three lawyers Sandoval County has assigned to defend Linda Gallegos’ actions. The county committed perjury during our protest hearing in their attempt to hide the truth of their actions and the county lawyers have now chosen to pursue frivolous procedural shenanigans in an attempt to avoid a review on the merits. We ask you to do the right thing under the constitution as well as state law - and we ask you to do this soon.

We provide below a summary from our protest, based on the data that was provided by the Sandoval County Assessor’s office (comp1,comp2,comp3 on the chart) as well as our own MLS data that was successfully used to challenge our 2023 valuations based on the proven truth of the unconstitutional flat rate method being applied in Corrales.